Consumer inflation ticked up 0.4 percent in February to an annual rate of 3.2 percent amid a jump in oil, gasoline, natural gas, transportation and shelter according to the latest data by the Bureau of Labor Statistics.

Gasoline was up 3.8 percent.

Fuel oil was up 1.1 percent.

Natural gas was up 2.3 percent.

Used cars and trucks were up 0.5 percent.

Apparel was up 0.6 percent.

Shelter was up 0.4 percent.

And transportation services were up 1.4 percent.

Although the rate of inflation has indeed slowed down from its 9.1 percent annual peak in June 2022 to its current rate of 3.2 percent, since Jan. 2021 when President Joe Biden took office, overall consumer prices are up almost 18.5 percent.

For comparison, from Jan. 2017 to Feb. 2020, prior to Covid, at that point consumer prices had increased 6.4 percent.

Meaning, what has already been experienced — and is still being felt — is triple what the American people were accustomed to prior to Covid and its resulting $7 trillion printing, borrowing and spending binge by the Federal Reserve and Congress.

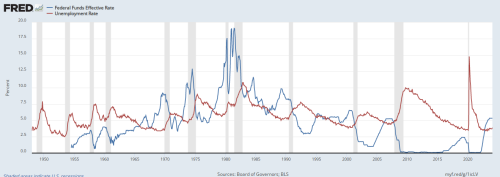

In the meantime, the Fed has been holding rates firm at 5.25 percent to 5.5 percent. But in its economic projections released in Dec. 2023, the central bank appears to be anticipating rate cuts to begin sometime this year, which is usually what happens when the economic cycle is ending and unemployment begins to rise, projecting the Federal Funds Rate to drop to 4.6 percent this year.

But that might change with the latest reading from the Bureau of Labor Statistics. On March 6, Federal Reserve Chairman Jerome Powell told Congress that the central bank wants to be certain inflation is headed back to its “normal” 2 percent a year bearing: “In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks… The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

This could indicate the Fed wants to get inflation down as far as possible before making any moves, and although the unemployment rate is off its historic low of 3.4 percent in April 2023 to its current rate of 3.9 percent in February, the Board of Governors is not panicking. As unemployment moves up, that is usually when the Fed will begin cutting rates as the cycle ends.

The fear could be that once the economic slowdown or recession is realized, unemployment will temporarily jump up, the Fed will cut rates and then robust inflation could be restored very quickly. For years, Biden has rejected there being any necessary tradeoffs between inflation and unemployment, but as the Fed keeps rates higher than the rate of consumer inflation and 898,000 jobs have been lost out of the household survey since Nov. 2023 that hypothesis will soon be tested.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.